Economy

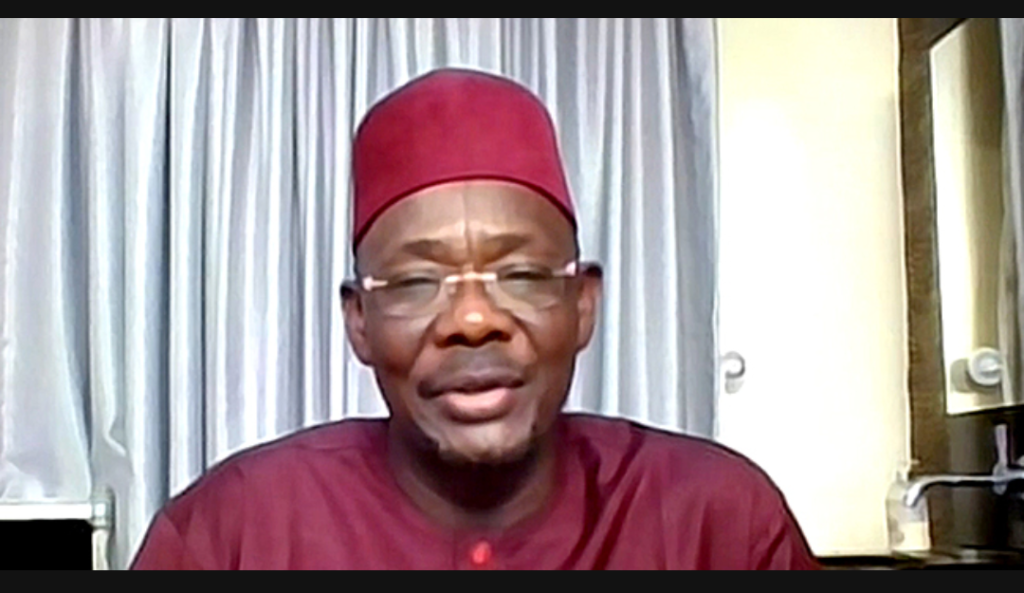

“Northern governors not opposed to tax reforms, just VAT distribution” – Abdullahi Sule

Abdullahi Sule, governor of Nasarawa state, has clarified that northern governors are not opposing the federal government’s tax reforms in entirety but are specifically against the removal of value-added tax (VAT) from the Federation Account Allocation Committee (FAAC). Sule addressed the matter on Thursday during the launch of innovative tax digital codes by the Nasarawa State Board of Internal Revenue Services (NSBIRS) in Lafia, the state capital.

The governor praised President Bola Tinubu’s administration for its commitment to tax reform but highlighted the potential challenges the northern region could face if VAT is excluded from FAAC allocations. “Let me make it categorically clear, we are not against the tax reforms. There are so many good things about the tax reforms that Mr. President is putting forward,” Sule said, as quoted by Daily Trust. “We just selected an item out of the tax reforms. It is the VAT that we are talking about, which would be taken out of the FAAC. That is why we are calling for a review of that position.”

Sule raised concerns over the proposed derivation-based VAT distribution model, noting that such a system would divert a significant portion of VAT revenue to regions where goods are consumed rather than where they are produced. “The moment you take VAT out of FAAC, you are taking 60 percent of that to go to derivation,” he explained. Drawing on his experience as a former managing director of major companies, he emphasized that VAT at the point of consumption could create complexities and inefficiencies in tax collection. “For people like me, who was once a managing director of some of the biggest companies, I was the one paying VAT. I was the one paying taxes; and I knew how it was paid. I know where some of these goods are consumed,” he stated.

To illustrate, Sule cited his experience as managing director of African Petroleum, recounting a scenario involving a customer from Maiduguri who ordered 200 trucks but requested only 10 to be delivered to Maiduguri, with the remaining trucks distributed from Ilorin to Sokoto. “If you say you are going to go by consumption, you are going to charge the VAT of the 200 trucks to Maiduguri. But in reality, at the point of distribution, he would now tell me to bring only 10 trucks to Maiduguri,” he explained, highlighting how the derivation model could lead to inaccuracies. “If you say it is at the point of derivation, then all the corporate headquarters that collected for the 200 trucks are in Lagos. Which means I pay in Lagos. Whichever way you pick, you are going into default.”

On October 13, President Tinubu submitted four tax reform bills to the National Assembly: the Nigeria Tax Bill, Tax Administration Bill, and Joint Revenue Board Establishment Bill. However, the Northern States Governors Forum (NSGF), representing 19 northern states, opposed the proposed shift to a derivation-based model for VAT. In a communiqué released after a meeting, the governors collectively rejected this distribution model, arguing it would disproportionately impact northern states. Sule reiterated this stance on October 29, calling the proposed derivation-based VAT sharing formula “unfair” to the northern region.

Follow us on social media:-

Crime7 hours ago

Crime7 hours agoIndian man sets wife ablaze for giving birth to three daughters

-

Celebrity Gossip & Gist7 hours ago

Celebrity Gossip & Gist7 hours ago“Nkubi’s wife tried not just by marrying him but also birthing a child for him. I personally can’t” – Woman says, receives heat over insensitive statement on Nkubi, his wife, and their child

-

News7 hours ago

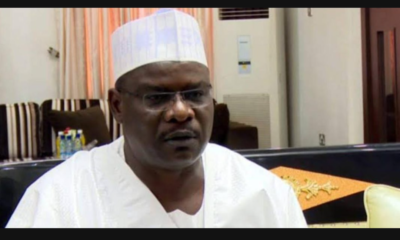

News7 hours agoNdume recounts how Saraki allegedly betrayed him; calls out Tinubu’s government for being ‘personalized’

-

News7 hours ago

News7 hours agoKid sues his own father for not buying him an expensive car (Video)