Economy

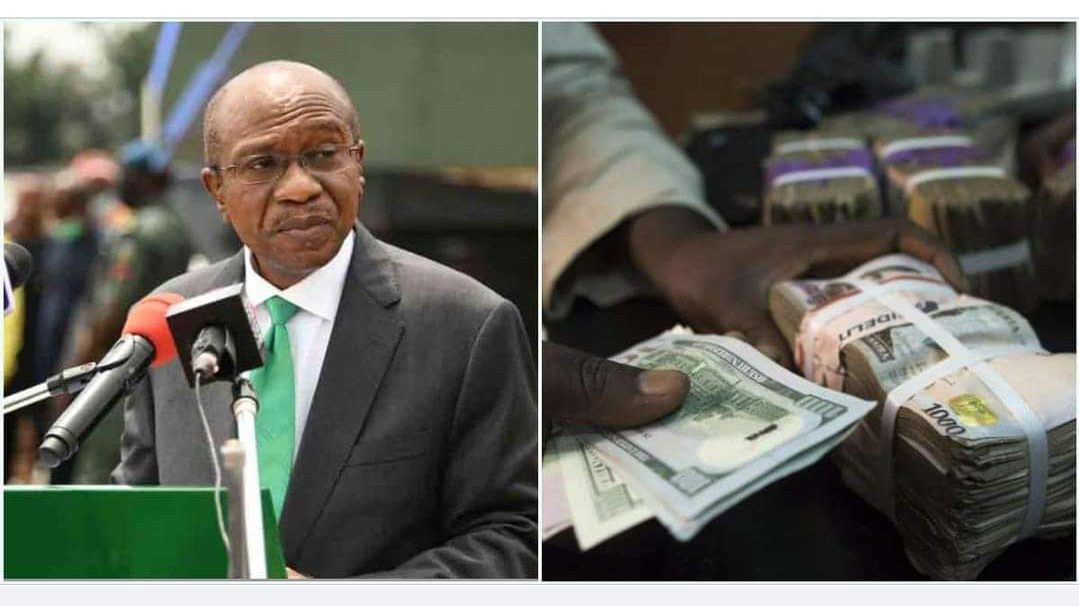

Not CBN, EFCC: The 3 Reasons Naira Bounced Back Quickly Than Usual After Falling To N900/$1

Financial analysts have provided deeper insights into why the Nigerian currency has recently recovered massively against US dollars, closing below N700 per dollar last week.

The Naira’s appreciation of more than 20% has been met with rapturous applause from Nigerians, who were concerned after it was named the world’s worst-performing currency.

You may recall that Naira was devalued shortly after the Central Bank of Nigeria announced a plan to redesign the Nigerian currency in order to mop up cash in the economy.

The naira fell significantly against the dollar due to the CBN redesign move, reaching as high as N900 to the dollar on the black market as many politicians and influential Nigerians exchange Naira for dollars.

The massive depreciation of the Naira against the dollar prompted the Economic Financial Crimes Commission to raid various Bureau de Change operators’ offices, blaming them for causing panic. Naira appreciates As fate would have it, the EFCC raid occurred during a period when the dollar was having a bad week.

According to BusinessDay, the Nigerian currency, which was on the verge of exchanging at N1000 to a dollar, closed 7 to 11 November 2022, trading week 26.24% stronger than it started at the parallel market. On Friday, November 11, Naira was quoted at N705 on Friday at the black market, compared to N890 a week earlier. Some traders in Ikotun, Airport roads, in fact, exchange Naira as low as N680 to a dollar.

Naira’s swift appreciation occurred just within three to four days on the back of losing 36.52 per cent of its value from January to November 2022. Analysts such as Ndubuisi Ekekwe called for caution as Nigerians applaud the work of the EFCC and other government agencies in helping the Naira.

Ekekwe, who is the lead faculty at the Tekedia Institute, explained that the Nigerian Naira, in recent days, has been rising against the US dollar on a solid rumour. According to him, nothing has changed regarding the Naira exchange rate to US dollars.

He added: “Fundamentally, nothing has changed. But no matter what, we need to be happy that Naira is getting some help – rumour or not. It has come down from 1,000/$ to about 680/$ now. I hope it goes down to N200/$ so that we can do reverse osmosis”

Several financial experts contacted by Legit.ng all share similar views noting that the reason behind the recent upsurge of the naira is majorly the events in the US. CNBC reports that the dollar suffered its biggest two-day drop in almost 14 years on Friday, 11 November 2022.

The drop follows the 7.7% year-on-year rise of consumer inflation, which beats the projected 8% by analysts, marking the slowest rate since January. Kunle Falyei, a financial analyst, noted that the dollar drop also triggered the jump of other currencies worldwide, just as the Naira.

For example, the Japanese yen gained 22% against the dollar in 2022, and the pound gained about 1.6% against the dollar. Chinese yuan rose by as much as 1.3% to hit its highest in over a month against the dollar. While the euro rose 1.5% to $1.0356, its highest since August 2022.

The Nigerian currency, Naira, has stated earlier, regained 26.2% of its value in the parallel market. Improve forex supply One fantastic occurrence from last week that appears to have benefited the Naira is the rumours that the US government, like the CBN, will be moping up dollars.

There were reports across some media outlets that the US will restrict the acceptance of dollars printed below 2021 to checkmate the dollar stockpile in Africa. As a result of the move, many Nigerians who had been stockpiling dollars to sell on the market were forced to sell to avoid losses quickly, therefore, rushed to sell, creating improved liquidity. BDCs operators confirmed that there had been an increase in dollar supply and a decrease in demand in the parallel market.

A trader, Jamal said:

“The changes in the rate are really very sudden, but it is as a result of increased dollars in the market compared to the high demand in the previous week.”

What next December 15, 2022, is just one month away until the new naira notes enter circulation, and what to expect in the lead-up to that date is extremely difficult to forecast. But one thing has been established few rich Nigerians can significantly solve Nigeria’s problem.

Following rumours that the US government planned to mop up dollar from African markets, the Naira gained more than 20% of its value. This demonstrates that just a few people can play a big role in helping the Naira recover its lost value, not just CBN.

Although the CBN increasing forex liquidity to fulfil genuine demand from the official market, and the federal government selling more crude oil for foreign exchange would also play a part in Naira’s full recovery.

Follow us on social media:-

Celebrity Gossip & Gist2 days ago

Celebrity Gossip & Gist2 days ago“The money wey dem pay me don expire” – Moment Burna Boy stops his performance at the Oando PLC end of the year party (Video)

-

Economy1 day ago

Economy1 day agoGoods worth millions of naira destroyed as fire guts spare parts market in Ibadan

-

Celebrity Gossip & Gist13 hours ago

Celebrity Gossip & Gist13 hours agoMoment stage collapses on Odumodublvck during concert performance (Video)

-

Economy12 hours ago

Economy12 hours agoPresident Tinubu cancels Lagos engagements in honor of food stampede victims