Economy

Bitcoin hits new all-time high of $100,000

Bitcoin hit $100,000 for the first time on Wednesday, surging to a new record after President-elect Donald Trump unveiled administration picks seen as holding the keys to ushering in crypto-friendly policies when he takes office in January.

Bitcoin has more than doubled in value this year and is up about 45 percent in the four weeks since Trump’s sweeping election victory.

The elections also saw a slew of pro-crypto lawmakers being elected to the US Congress.

“We’re witnessing a paradigm shift. After four years of political purgatory, bitcoin and the entire digital asset ecosystem are on the brink of entering the financial mainstream,” Reuters reported, quoting Mike Novogratz, founder and CEO of US crypto firm Galaxy Digital, s saying.

“This momentum is fueled by institutional adoption, advancements in tokenization and payments, and a clearer regulatory path.”

Trump has nominated cryptocurrency lobbyist Paul Atkins to lead the Securities and Exchange Commission, a sign that his administration will take a friendlier approach to the digital assets that have boomed in value in recent years despite concerns about their financial risks.

Reaching a six-figure price amounts to a significant milestone for Bitcoin. The digital currency was created in 2008 as strings of computer code, with no physical form, by a software developer using the pseudonym Satoshi Nakamoto, whose identity has still not been confirmed.

Proponents have hailed the coin, and the wider crypto space, as the future of finance. But its climb in valuation has been extraordinarily bumpy, and predictions that it could become a mainstream alternative means of payment for goods and services have so far failed to materialize.

“Bitcoin crossing $100,000 is more than just a milestone; it’s a testament to shifting tides in finance, technology and geopolitics,” said Justin d’Anethan, a Hong Kong-based independent crypto analyst.

“The figure not that long ago dismissed as fantasy stands as a reality.”

Trump, who himself once branded Bitcoin a “scam”, reversed his position during his latest bid for presidency.

His campaign accused the Democrats of embarking upon an “un-American crypto crackdown” under Joe Biden, and pledged to defend Bitcoin mining, the ability of US citizens to hold crypto assets, and transactions “free from Government Surveillance and Control”.

Crypto investors see an end to increased scrutiny under US Securities and Exchange Commission Chair Gary Gensler, who said last week he would step down in January when Trump takes office.

On Wednesday, Trump said he would nominate Paul Atkins to run the Securities and Exchange Commission (SEC).

Atkins, a former SEC commissioner, has been involved in crypto policy as co-chair of the Token Alliance, which works to “develop best practices for digital asset issuances and trading platforms,” and the Chamber of Digital Commerce.

A slew of crypto companies including Ripple, Kraken and Circle are jostling for a seat on Trump’s promised crypto advisory council, seeking a say in his planned overhaul of US policy, according to several digital asset industry executives.

Trump’s businesses may also have a stake in the sector, with the President-elect unveiling a new crypto business, World Liberty Financial, in September.

Although details about the business have been scarce, investors have taken his personal interest in the sector as a bullish signal.

Trump’s social media company is in advanced talks to buy crypto trading firm Bakkt, the Financial Times reported last week, citing two people with knowledge of the talks.

Billionaire Elon Musk, a major Trump ally, is also a proponent of cryptocurrencies.

Bitcoin’s rebound from a slide below $16,000 in late 2022 has been rapid, boosted by the approval of US-listed bitcoin exchange-traded funds in January this year.

The SEC had long attempted to block ETFs from investing in bitcoin, citing investor protection concerns, but the products have allowed more investors, including institutional investors, to gain exposure to bitcoin.

More than $4 billion has streamed into US-listed bitcoin exchange-traded funds since the election.

Crypto-related stocks have soared along with the bitcoin price, with shares in bitcoin miner MARA Holdings up around 65 percent in November.

Two years ago, the industry was wracked by scandal with the collapse of the FTX crypto exchange and the jailing of its founder Sam Bankman-Fried.

The cryptocurrency industry also has been criticized for its massive energy usage, while crypto crime remains a concern, too.

Market participants are keeping a close eye on what happens now that bitcoin has broken above $100,000, with investors and speculators possibly looking to pocket some of their recent gains.

-

News2 days ago

News2 days agoCaucasian woman flies from her country to Africa to marry her young lover (Video)

-

Crime2 days ago

Crime2 days agoLagos teacher sentenced to life imprisonment for r3ping 8-year-old pupil

-

Love & Relationship2 days ago

Love & Relationship2 days agoPolice arrest man for b£ating his wife to d3ath in Lagos

-

Celebrity Gossip & Gist2 days ago

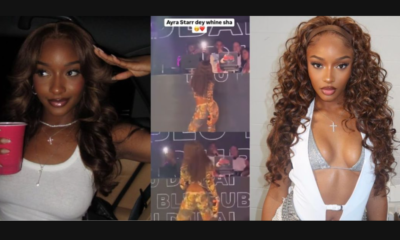

Celebrity Gossip & Gist2 days ago“Small yansh dey shake oh” – Ayra Starr stirs the internet as she whines her waist at a recent performance in Dubai (Video)