News

CBN Announces: If Your Money Is In Any Of These Popular Banks. Act Now

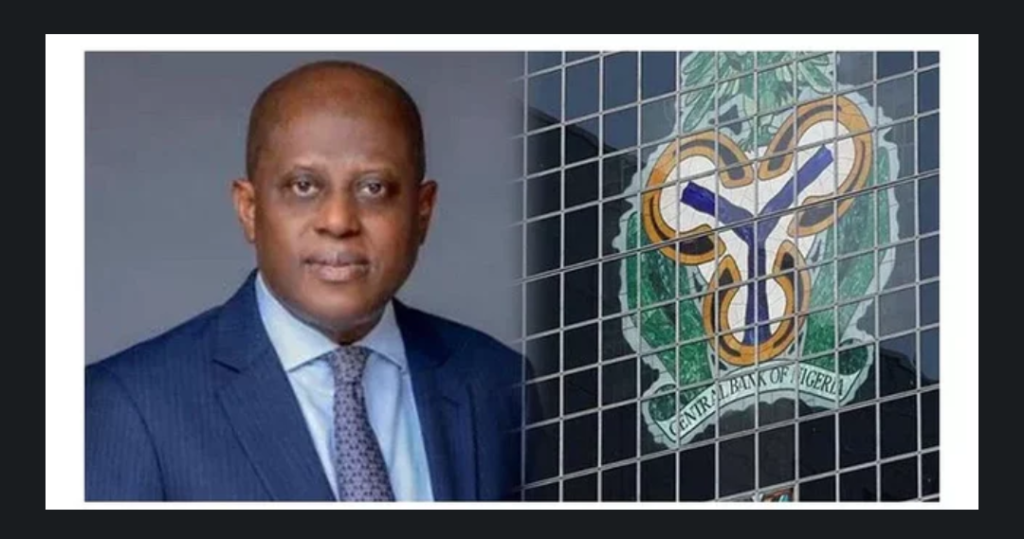

The Central Bank of Nigeria (CBN) has given the green light for financial assistance to support the proposed merger between Unity Bank Plc and Providus Bank Limited. This move is aimed at strengthening the stability of Nigeria’ s financial system and preventing potential risks that could affect the entire system.

In a released by Hakama Sidi- Ali, the acting Director of Corporate Communications for the CBN, it was emphasized that the merger depends on the financial support from the CBN. The provided funds will be crucial in helping Unity Bank settle its obligations to the Central Bank and other stakeholders.

“The merger is contingent upon the financial support from the CBN. The fund will be instrumental in addressing Unity Bank’ s total obligations to the Central Bank and other stakeholders, ” the statement read.

This action is taken under the provisions of Section 42 (2) of the CBN Act, 2007. It is seen as vital for ensuring the financial health and operational stability of the newly merged organization. The CBN also stressed that no other Nigerian bank is currently in a situation as dire as Heritage Bank, which was recently liquidated.

The Central Bank remains dedicated to protecting depositors’ interests and ensuring the smooth operation of the banking sector through proactive measures and strategic interventions.

Heritage Bank failed to comply with Section 12 (1) of BOFIA 2020, which led to regulatory intervention. Despite various supervisory measures from the CBN aimed at improving the bank’ s declining financial performance, Heritage Bank was unable to restore its financial health. The continuous underperformance posed a significant threat to financial stability, prompting the CBN to revoke its license.

The CBN highlighted that this action is crucial for reinforcing public confidence in the Nigerian banking sector and ensuring the integrity and soundness of the financial system. The support for the Unity Bank and Providus Bank merger is seen as a necessary step in maintaining stability and preventing systemic risks within the financial system.

By taking these measures, the CBN demonstrates its commitment to safeguarding the interests of depositors and ensuring a stable and reliable banking environment in Nigeria.

-

Economy2 days ago

Economy2 days agoGoods worth millions of naira destroyed as fire guts spare parts market in Ibadan

-

Celebrity Gossip & Gist24 hours ago

Celebrity Gossip & Gist24 hours agoMoment stage collapses on Odumodublvck during concert performance (Video)

-

Economy23 hours ago

Economy23 hours agoPresident Tinubu cancels Lagos engagements in honor of food stampede victims

-

Celebrity Gossip & Gist23 hours ago

Celebrity Gossip & Gist23 hours ago“The quality of a woman isn’t measured by the hair on her head but by her brain” – Yul Edochie cautions ladies against killing themselves over expensive hair this Christmas