News

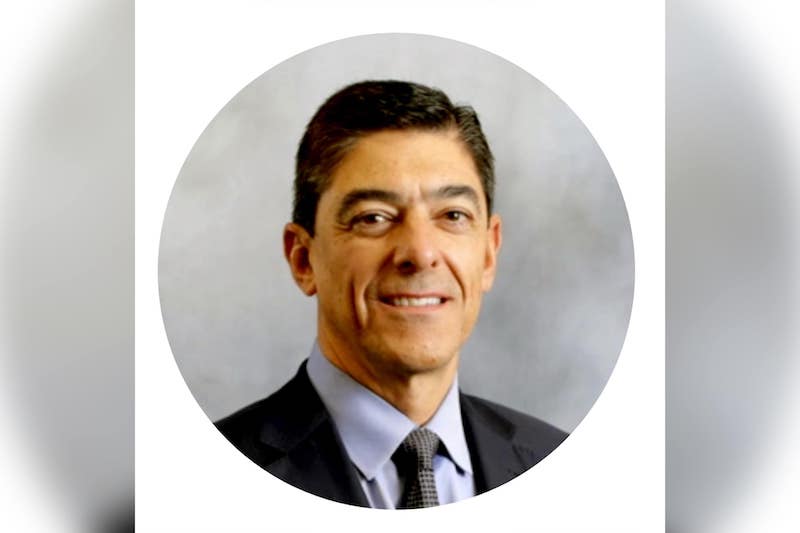

U.S. company’s CFO Gustavo Arnal jumps to death in New York

Bed Bath & Beyond Inc’s chief financial officer fell to his death from New York’s Tribeca skyscraper on Friday afternoon, days after the struggling retailer announced it was closing stores and laying off workers..

Gustavo Arnal, 52, joined Bed Bath & Beyond in 2020. He previously worked as CFO for cosmetics brand Avon in London and had a 20-year stint with Procter & Gamble, according to his LinkedIn profile.

On Friday at 12:30 p.m. ET (1630 GMT), police responded to a 911 call and found a 52-year-old man dead near the building who suffered injuries from a fall. Police identified the man as Gustavo Arnal.

The police statement did not provide further details on the circumstances leading to Arnal’s death and said the New York City Medical Examiner’s Office would determine the cause of death. Bed Bath & Beyond confirmed his death in a press statement on Sunday but gave no details.

The big-box chain – once considered a so-called “category killer” in home and bath goods – has seen its fortunes falter after an attempt to sell more of its own brand, or private-label goods.

Last week, Bed Bath & Beyond said it would close 150 stores, cut jobs and overhaul its merchandising strategy in an attempt to turn around its money-losing business.

It forecast a bigger-than-expected 26% slump in same-store sales for the second quarter and said it would retain its buybuy Baby business, which it had put up for sale.

Arnal sold 55,013 shares in Bed Bath & Beyond in multiple transactions on Aug. 16-17, Reuters’ calculations showed based on SEC filings. The sales amounted to about $1.4 million, and Arnal still had almost 255,400 shares remaining.

On Aug. 23, the company, Arnal and major shareholder Ryan Cohen were sued over accusations of artificially inflating the firm’s stock price in a “pump and dump” scheme, with the lawsuit alleging Arnal sold off his shares at a higher price after the scheme.

The class action lawsuit listed Arnal as one of the defendants and was brought by a group of shareholders who claimed they lost around $1.2 billion.

The filing in the U.S. District Court for the District of Columbia alleged that Arnal “agreed to regulate all insider sales by BBBY’s officers and directors to ensure that the market would not be inundated with a large number of BBBY shares at a given time.”

The lawsuit also alleged that he issued materially misleading statements to investors.

The company said it was “in the early stages of evaluating the complaint, but based on current knowledge the company believes the claims are without merit.”

Shares in Bed Bath & Beyond have been highly volatile in recent months, being viewed as a so-called “meme” stock, which trade more on social media sentiment than economic fundamentals.

Cohen, a billionaire investor, disclosed a stake of nearly 10% in early March. Cohen’s RC Ventures disclosed plans to sell its stake on Aug. 17. read more.

-

Celebrity Gossip & Gist2 days ago

Celebrity Gossip & Gist2 days ago“The money wey dem pay me don expire” – Moment Burna Boy stops his performance at the Oando PLC end of the year party (Video)

-

Economy2 days ago

Economy2 days agoGoods worth millions of naira destroyed as fire guts spare parts market in Ibadan

-

Celebrity Gossip & Gist13 hours ago

Celebrity Gossip & Gist13 hours agoMoment stage collapses on Odumodublvck during concert performance (Video)

-

Economy13 hours ago

Economy13 hours agoPresident Tinubu cancels Lagos engagements in honor of food stampede victims