News

We’re heading for second recession in four years – FG

The Federal Government, on Thursday, raised the alarm that the Nigerian economy might relapse into a second recession in four years if no concrete steps were taken to improve the Gross Domestic Product.

The Minister of State for Budget and National Planning, Clem Agba, raised the alarm during his presentation at the Senate Joint Committee on Finance and Economic Planning on the 2021-2023 Medium-Term Expenditure Framework and Fiscal Strategy Paper..

He said, “Nigeria’s Q2 GDP growth is in all likelihood negative, and unless we achieve a very strong Q3 2020 economic performance, the Nigerian economy is likely to lapse into a second recession in four years with significant adverse consequences.

“In response to the developments affecting the supply of foreign exchange to the economy, the Central Bank of Nigeria adjusted the official exchange rate to N360/US$1, and more recently to N379/US$.”

He explained that the disruptions in global trade and logistics would negatively affect customs duty collection in 2020.

He added that the COVID-19 containment measures, though necessary, had inhibited domestic economic activities, with consequential negative impact on taxation and other government revenues.

“Consequently, the projections for Customs Duty, Stamp Duty, Value Added Tax, and Company Income Tax revenues were recently reviewed downwards in the revised 2020 budget,” he said.

Speaking more specifically on the revenue performance from January to June 2020, the minister said as of the end of June 2020, the Federal Government’s retained revenue was N1.81tn, 68 per cent of the prorate target.

He said the Federal Government had intoduced fiscal measures aimed at improving revenue and entrenching a regime of prudence with emphasis on achieving value for money.

He said the goal of the fiscal interventions, was to keep the economy active through carefully calibrated regulatory or policy measures designed to, among others, boost domestic value-addition, de-risk the enterprise environment, attract external investment and sources of funding.

Agba said that the Federal Government was also improving the tax administration framework to optimise government revenue.

-

Love & Relationship1 day ago

Love & Relationship1 day agoChidimma Adetshina crowned Miss Universe Africa, Oceania

-

Celebrity Gossip & Gist1 day ago

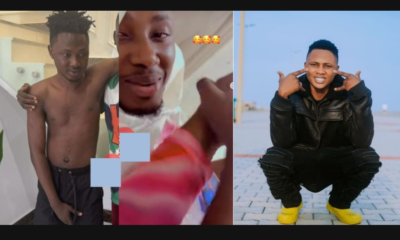

Celebrity Gossip & Gist1 day ago“He con fresh and sound so cool” – New video shows TikToker Salo recovering in hospital weeks after being shot in Lagos (Watch)

-

Celebrity Gossip & Gist4 hours ago

Celebrity Gossip & Gist4 hours agoCardi B queries son over relationship status, gives shocking response

-

News4 hours ago

News4 hours agoLondoner recounts how Nigerian man got dumped by wife after sponsoring her UK law degree (Video)