News

Mark Zuckerberg loses $18.8 billion in just 2hrs, drops from fourth to eighth in world’s richest ranking

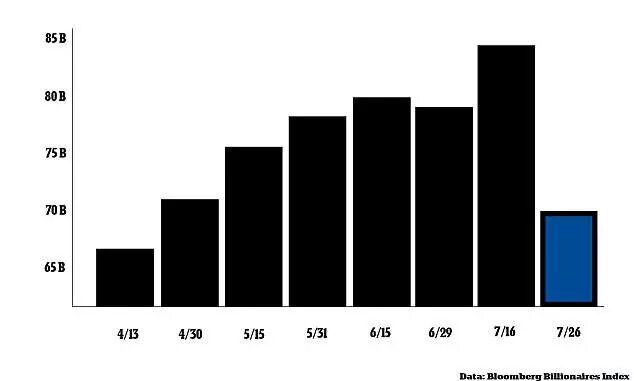

Mark Zuckerberg lost nearly $20billion in just two hours on Wednesday.

The Facebook CEO saw his net worth tumble by $18.8billion, a record drop, in after-hours trading, taking him down four spots in Forbes’ World Billionaires List.

Zuckerberg woke up as the fourth richest person in the world with an $82.4billion net worth on Wednesday but was in the eighth spot by the end of the day.

The massive hit came as Facebook’s shares plunged by $150billion after the tech giant failed to meet Wall Street’s estimates for user growth and quarterly revenue.

Mark Zuckerberg lost nearly $20billion in just two hours on Wednesday as Facebook’s shares plunged by $150billion

The Facebook CEO saw his net worth tumble by $18.8billion in after-hours trading, a record-drop that took him down four spots in Forbes’ World Billionaires List

Facebook’s shares fell 16 percent to $181.89 as of 5.30pm ET, according to Forbes.

Just 18 minutes later, it dropped to $167 – bringing Zuckerberg’s net worth to $63.6billion.

By Wednesday evening, almost $150 billion had been wiped off of Facebook’s market cap as a result of the stock’s plunge.

Daily active users (DAUs) – DAUs were 1.47 billion on average for June 2018, an increase of 11% year-over-year.

Monthly active users (MAUs) – MAUs were 2.23 billion as of June 30, 2018, an increase of 11% year-over-year.

Mobile advertising revenue – Mobile advertising revenue represented approximately 91% of advertising revenue for the second quarter of 2018, up from approximately 87% of advertising revenue in the second quarter of 2017.

Capital expenditures – Capital expenditures for the second quarter of 2018 were $3.46billion.

Cash and cash equivalents and marketable securities – Cash and cash equivalents and marketable securities were $42.31billion at the end of the second quarter of 2018.

Headcount – Headcount was 30,275 as of June 30, 2018, an increase of 47% year-over-year.

The disappointing results come after Facebook has been embroiled in a data scandal affecting millions of users – an event that the firm’s top leadership acknowledged as a factor weighing on user growth during the second quarter.

Total monthly active users came in at 2.23 billion, which fell short of analysts’ estimated 2.25 billion.

Users in Europe dropped from 377 million to 376 million, partly as a result of the new General Data Protection Regulation rules.

Facebook executives made investors even more nervous when they warned of further revenue deceleration in a call with analysts.

CFO David Wehner said Facebook expects to see high-single digit drops in year-over-year revenue growth during the next few quarters.

He cited the new GDPR rules, user privacy controls and currency headwinds as factors contributing to the deceleration.

Wehner reiterated that GDPR didn’t have a significant impact on revenues because it was implemented toward the tail-end of the quarter, but he said that could change in the coming quarters.

The Cambridge Analytica scandal prompted several apologies from Zuckerberg and generated calls for users to desert Facebook, which has grown strongly since launching as a public company in 2012.

Ad sales in Facebook’s second quarter rose 42 percent to $13.04billion but costs, bolstered by moves to improve content and security after the data scandal, rose 50 percent from a year earlier to $7.37billion.

Shares of Facebook dipped more than 20% to $173.73 in after-hours trading on Wednesday

Shares of Facebook dipped more than 20% to $173.73 in after-hours trading on Wednesday

Facebook lost some customers in Europe after the stringent General Data Protection Regulation (GDPR) came into affect. Facebook execs called it a ‘modest’ drop in users

Facebook lost some customers in Europe after the stringent General Data Protection Regulation (GDPR) came into affect. Facebook execs called it a ‘modest’ drop in users

Total revenue rose 41.9 percent to $13.23billion, while Wall Street was looking for revenue of $13.36billion.

Ahead of the announcement, industry experts had predicted that the number of active users visiting the social network would either drop or flat line.

Facebook has never reported anything other than user growth in Europe.

Still, Zuckerberg assured investors that Facebook continues to see growth on its core platform, as well as its other properties, which include Instagram, WhatsApp and Messenger.

For the first time ever, Zuckerberg provided user growth data on those properties, saying that Facebook now has 2.5 billion people who use at least one of its apps, referring to users who may have an Instagram account, as well as a Facebook profile.

‘Our community and business continue to grow quickly,’ said Mark Zuckerberg.

‘We are committed to investing to keep people safe and secure, and to keep building meaningful new ways to help people connect.’

-

Celebrity Gossip & Gist2 days ago

Celebrity Gossip & Gist2 days ago“The money wey dem pay me don expire” – Moment Burna Boy stops his performance at the Oando PLC end of the year party (Video)

-

Economy2 days ago

Economy2 days agoGoods worth millions of naira destroyed as fire guts spare parts market in Ibadan

-

Celebrity Gossip & Gist17 hours ago

Celebrity Gossip & Gist17 hours agoMoment stage collapses on Odumodublvck during concert performance (Video)

-

Economy16 hours ago

Economy16 hours agoPresident Tinubu cancels Lagos engagements in honor of food stampede victims