News

Savanna Brokerage: Ponzi Scheme Crashes in Ghana, as Scores Lose Millions

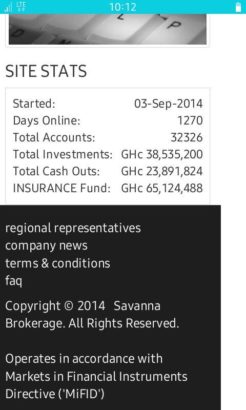

Thousands of Ghanaians who ‘invested’ in an online investment scheme, Savanna Brokerage, are counting their losses, crying their eyes out as the digital platform has been inaccessible for weeks.

It is estimated that funds amounting to over GHC2million (about N163million) was invested in Savanna Brokerage across the country by Ghanaians.

Ghana’s Central Bank and the Securities and Exchange Commission; the major financial regulators are yet to comment on the development but Starr Business says they can confirm that Savanna Brokerage has no license to receive and invest funds in Ghana.

Savanna Brokerage Background:

Based on the address on the website before it went down, Savanna Brokerage is a Kenyan company pointing to a location in Nairobi.

According to the Savanna Brokerage website , the company started operations in Ghana from 2014.

They were operating three packages; Knight Package, Queen Package and Kings Package.

Savanna Brokerage Knight Package was a weekly form of investment – every customer was to invest more than GH 50. You were promised 10% on your money on weekly basis so you get 40% return on your capital at the end of the month.

In Savanna Brokerage Queen package ; you get 60% on your investment money after a month.

Savanna Brokerage Kings Package promised 100% return on an investment. The investment was to last for three months.

To invest, the victims say, the money is to be paid through an MTN Merchant and the operators of the scheme get access to the funds.

Currently, MTN appears to have blocked all the merchant accounts. But there are huge monies stuck in the accounts.

The merchants are not able to go for the funds due to some irregularities and tax issues. The accounts are also under investigation by the telecom company.

When contacted, an official of MTN said the company is not in the position to comment on the issue.

Savanna Brokerage Customers’ reaction:

Since the Savanna Brokerage website went down about two months ago, customers have begun galvanizing themselves for a class action.

They have formed regional and intercity Telegram and WhatsApp groups to push their concern.

StarrFm reports one of the affected customers told Starr Business’ Osei Owusu Amankwaah that,

“The caliber of people who have invested in Savanna belong to the Elite. Some students also used their Student Loans and Fees to invest. I know someone who has invested GHC60,000. He is going mad. This is a very troubling development.”

Savanna Brokerage customers are hopeful that they might retrieve some of the funds due to the fact that MTN has blocked the merchant accounts which has about GHC2 million.

Savanna Brokerage Investigation:

Starr Business reports they gathered that some customers have lodged complaints with the Police. MTN has also begun intensive investigations into the matter.

Ghana/Starrfmonline.com/103.5FM/Osei Owusu Amankwaah adds that Banking consultant, Nana Otuo Achampong is admonishing Ghanaians to be more rigorous and check for regulatory approval before any investment.

Follow us on social media:-

Celebrity Gossip & Gist1 day ago

Celebrity Gossip & Gist1 day ago“The money wey dem pay me don expire” – Moment Burna Boy stops his performance at the Oando PLC end of the year party (Video)

-

Economy1 day ago

Economy1 day agoGoods worth millions of naira destroyed as fire guts spare parts market in Ibadan

-

Celebrity Gossip & Gist4 hours ago

Celebrity Gossip & Gist4 hours agoMoment stage collapses on Odumodublvck during concert performance (Video)

-

Economy3 hours ago

Economy3 hours agoPresident Tinubu cancels Lagos engagements in honor of food stampede victims