Economy

Nigeria’s Foreign Debts Hit $15.05bn In June – NBS

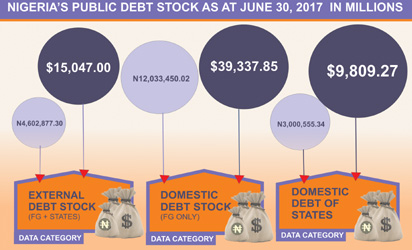

The National Bureau of Statistics, NBS, yesterday, said Nigeria’s foreign debt stood at $15.05 billion, while the domestic debt portfolio was put at N14.06 trillion in June this year.

According to the NBS, this represents a growth of $3.64 billion and N0.04 trillion respectively within a six month period.

Investigations by Vanguard showed that the foreign debt profile was $11.41 trillion, while domestic debt was N14.02 billion at the end of December 2016.

The NBS in its report on Nigerian Domestic and Foreign Debt – June 2017 data, showed that $9.67 billion of the debt was multilateral; $218.25 million, bilateral, while $5.15 billion was from the Exim Bank of China, credited to the Federal Government.

The report stated: “The total Federal Government debt accounted for 74 per cent of Nigeria’s total foreign debt while all states and the Federal Capital Territory, FCT, accounted for the remaining 26 per cent.

“Similarly, total Federal Government’s debt accounted for 78.66 per cent of Nigeria’s total domestic debt, while all states and the Federal Capital Territory, FCT, accounted for the 21.34 percent balance.”

A breakdown of the Federal Government domestic debt stock by instruments reflected that N7.5 trillion or 68.41 per cent of the debt was in Federal Government Bonds.

About N3.3 trillion or 29.64 per cent are in treasury bills, while N215.99 million or 1.95 percent are in treasury bonds.

The report read further: “Lagos State has the highest foreign debt profile among the 36 states and the FCT, accounting for 37 per cent; Kaduna, 6 per cent; Edo, 5 per cent; Cross River, 4 per cent; and Ogun, 3 per cent, followed closely.”

Similarly, the report stated: “ Lagos State had the highest domestic debt profile among the thirty-six states and the FCT, accounting for 10.39 per cent; Delta, 8.04 per cent; Akwa Ibom, 5.18 per cent; FCT, 5.09 per cent; and Osun, 4.90 per cent, followed in that order.”

Not surprising, says Capital Bancorp boss

Reacting to the figures, Managing Director/ Chief Executive Officer, Capital Bancorp Plc, Mr. Aigboje Higo, said: “It is not a surprise that we are seeing increase in our debt profile. The government has always talked about borrowing to finance the deficit as well as jump-start growth. Yes, we need to be careful, even though the DMO has assured the country that our debt profile is still sustainable.

“The key worry is that we use the borrowed funds efficiently and grow the economy in an inclusive manner.”

ANLCA boss cautions on govt spending

President of the Association of Nigerian Licensed Customs Agents, ANLCA, Prince Olayiwola Shittu, who spoke on behalf of operators in the maritime sector, cautioned on the spending pattern of government.

He said spending not directed at the right projects and infrastructure could lead to more economic problems.

He said: “As long as the foreign deposit is not strengthened, the Naira will continue to be weak against other international currencies.

“The implication is that less Nigerians will import less cargoes and this will lead to loss of jobs for Customs brokers and freight forwarders and consequently affects Customs revenue.”

Former Senior Special Adviser to former President Goodluck Jonathan on Maritime matters, Mr. Leke Oyewole, said: “If the borrowed monies are being used to boost agriculture, and Small Medium Enterprises, sustain power to increase production, then the government is on the right track.

“Coming out of the recession, the government wants to ensure that it stabilizes the dollar to boost economic activities and create employment, then Nigerians should not panic, but if on the other hand the monies are being used to pay debt, then we are going to be in a big economic trouble.”

Rising debt’ll have negative impact

Mr. Ayo Akande of of Scib Insurance Brokers said: “You cannot rule out borrowing by any country, even where the economy is doing extremely well. However, money being borrowed should have an impact on every citizen of the country.

“Although if borrowings continue to grow, they will have negative impact on the economy because the debt has to be serviced and servicing will put pressures on the economy.

“Also, the lender matters a lot because some organizations like the IMF could dictate devaluation of your currency when the debt grows to a particular extent. So, if we depend on borrowed money, interest will continue to grow and if borrowings continue to grow, it will have negative impact on the country because you have to pay back capital and interest.”

Follow us on social media: