Economy

How To Avoid Over-Spending

Money can be such a fluid thing. It goes much more easily than it comes, and is a difficult thing to control. Most times, expenses upon expenses will come and before you realise it a good chunk of your money is gone. It really can be stressful.

Jumia Travel shares 5 ways to help you avoid overspending and the stress that comes with it.

HAVE A BUDGET

This cannot be overemphasized. If you don’t want to overspend, you have to have a budget. You can’t continue to spend spontaneously and expect a miracle to happen.

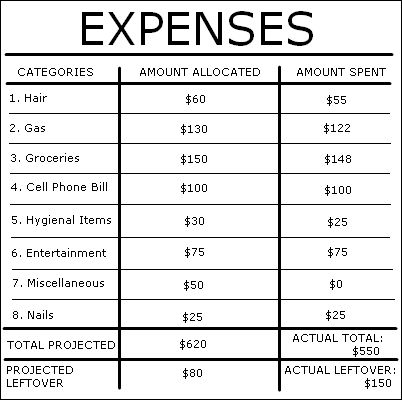

You might feel like having a budget is too tedious or too technical but it really isn’t, or at least it doesn’t have to be. Creating a budget is as easy as the sample below:

IMPROVE YOUR BUDGET

Many times, even with a budget, we still end up overspending. A reason for this, most times, is that our budgets are not feasible and do not sufficiently cover our legitimate expenses. In this case, you should improve on your budget so it is more realistic, captures your legitimate needs and is easy to follow.

Legitimate expenses largely consist of your variable expenses. Things like entertainment, clothing, foodstuffs, and transportation are your variable expenses. Most times, when we initially create a budget we are too tight with our variable expenses because we are trying to rein them in and avoid overspending on them.

When you are too tight with your variable expenses you end setting yourself up for failure. This doesn’t mean you should be excessive in the amount you allocate for these variables (if you could afford to be excessive you won’t need a budget in the first place), but you should be honest enough with yourself to acknowledge how much you really need to sufficiently take care of them. You can base this on how much you’ve spent on them in the past and how much you can realistically afford to spend on them now.

USE CASH

The cashless society that ours is gradually turning into can be a good thing, but not if you’re trying to avoid overspending. Avoid taking your debit cards with you everywhere, especially when you are going out for entertainment. Stick to a cash-only budget system that forces you to stick to your budget. There is nothing that motivates you not to overspend more than when you know you don’t have any surplus money with you to overspend with.

DISCIPLINE

In the end it all boils down to discipline. You have to learn to discipline yourself not to overspend and, as much as you can, avoid situations that can make you overspend. Occasionally, you can depend on a friend or family member for support and accountability in helping you curb overspending.

GIVE YOURSELF A TREAT

From time to time, when you have successfully stuck to your budget and avoided overspending, do something nice for yourself with your money to commend yourself for the effort. It helps to encourage you and becomes a sort of reward you give yourself for the short-term financial goals you successfully achieved.

Again, it’s important to remember that you set these financial goals for yourself first, achieve them and then reward yourself by spending some, not all the money you have been able to save. Don’t be excessive with it.

Follow us on social media:-

Celebrity Gossip & Gist1 day ago

Celebrity Gossip & Gist1 day agoMoment stage collapses on Odumodublvck during concert performance (Video)

-

Economy1 day ago

Economy1 day agoPresident Tinubu cancels Lagos engagements in honor of food stampede victims

-

Celebrity Gossip & Gist1 day ago

Celebrity Gossip & Gist1 day ago“The quality of a woman isn’t measured by the hair on her head but by her brain” – Yul Edochie cautions ladies against killing themselves over expensive hair this Christmas