Economy

S&P Global Ratings Downgrades Nigeria Further Into Junk Status – Bloomberg

S&P Global Ratings downgraded Nigeria further into junk territory just as Africa’s most populous nation prepares to issue its first Eurobond since 2013, amid low oil prices and severe shortages of foreign exchange.

S&P lowered Nigeria’s rating one level to B, five levels below investment grade and in line with Kyrgyzstan and Angola. The outlook was changed from negative to stable.

“Nigeria’s economy has weakened more than we expected owing to a marked contraction in oil production, a restrictive foreign exchange policy and delayed fiscal stimulus,” S&P said Friday in an e-mailed statement after markets closed. While government debt remains low, “servicing costs as a percentage of general government revenues are high and rising,” the company said.

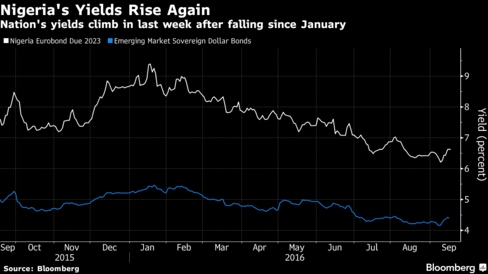

The rating cut comes as Nigeria prepares to issue a dollar bond before the end of the year. The Debt Management Office asked banks wanting to manage a $1 billion deal to place bids by Sept. 19. Yields on the nation’s $500 million of securities due in July 2023 have fallen almost 280 basis points to 6.63 percent since peaking at 9.4 percent on Jan. 18. The bonds have returned 14 percent this year, compared with the average of 16 percent for Sub-Saharan African sovereign dollar debt, according to Bloomberg indexes.

“The deterioration of the Nigerian credit has been going on for years,” Jan Dehn, head of research at Ashmore Group Plc., which manages about $53 billion of emerging market assets, said by phone from London. The country needs to show progress opening its markets and letting its currency, the naira, trade freely, he said.

The downgrade is the latest blow to the economy, which shrank in the last two quarters and is headed for its first full-year recession since 1991, according to the International Monetary Fund. While President Muhammadu Buhari’s government announced a record budget for 2016 to stimulate the economy, it is struggling to finance infrastructure projects, as well as pay civil servants’ salaries.

‘Justified Downgrade’

“An economy in recession and with a devaluation means something is wrong,” Babajide Solanke, an analyst at Lagos-based FSDH Merchant Bank Ltd., said by phone from the commercial hub. “The downgrade is justified” and will make Nigeria’s foreign and domestic bonds less attractive, he said.

Investors will be concerned about the risk posed by falling oil prices on the government’s ability to pay back the debt, Solanke said.

Nigeria, Sub-Saharan Africa’s second largest crude producer, has seen government revenue squeezed by the fall in global oil prices to roughly half their levels from 2014. In addition, attacks claimed by militants in the oil-producing Niger River delta region have pushed monthly crude exports to the lowest in 27 years in May.

S&P expects Nigeria’s economy to contract 1 percent this year before returning to growth. Real gross domestic product is likely to expand 2 percent in 2017 and 4 percent the following year, it said in the statement.

“We believe that since passing the fiscal budget, government spending together with liberalization of the interbank foreign-exchange market, may boost the economy and spur positive GDP growth next year,” S&P said. Oil output may improve in the fourth quarter as government negotiates with militants and vandalized pipelines are repaired, it said.

Moody’s Investors Service and Fitch Ratings Ltd. each downgraded Nigeria to four levels below investment grade in the first half of the year.

Follow us on social media:-

Celebrity Gossip & Gist23 hours ago

Celebrity Gossip & Gist23 hours ago“Why It’s a sin to marry only one or two wives” – Nollywood actor, Uwaezuoke advises men

-

News23 hours ago

News23 hours agoINEC Speaks On Manipulating Edo Governorship Election

-

Celebrity Gossip & Gist2 days ago

Celebrity Gossip & Gist2 days ago”Competition has started again” – Reactions trail Regina Daniels and co-wife, Laila’s posts about their husband, Ned Nwoko

-

Crime23 hours ago

Crime23 hours agoTwo Anambra revenue collectors set ablaze by irate mob for causing de@th of innocent bystander