Economy

Leaked Documents Shows That Diamond Banks Sacked Over 400 Workers, Instead of 200

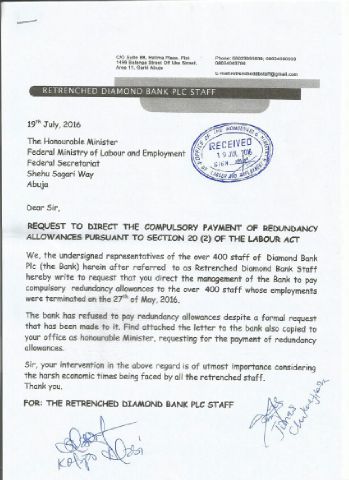

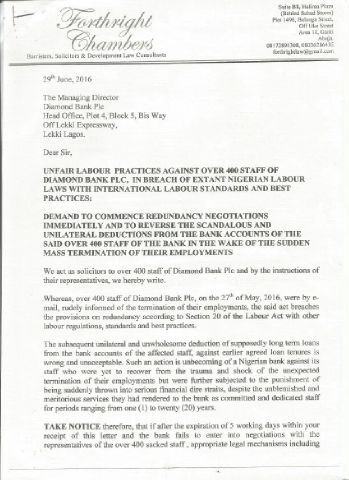

Documents have been released to support the claims that Diamond Bank Nigeria Plc actually laid off 400 workers as against the 200 it earlier alleged. A lawyer based in Abuja, Mr Frank Tietie, had earlier accused the management of the bank of unfair labour practices against some recently sacked workers of the bank. The lawyer, in a letter dated June 29, and addressed to the Managing Director of the bank, as saying that the workers were “rudely’’ informed of their sack by e-mail on May 27.

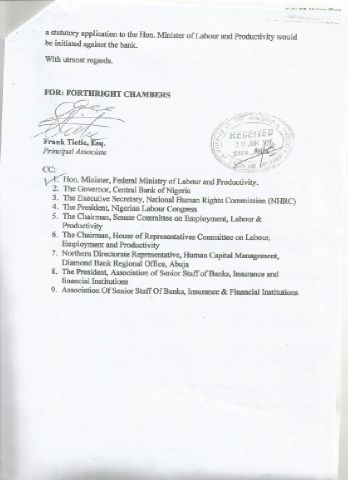

He said that the action breached the provisions of Section 20 of the Labour Act on redundancy as well as “ other labour regulations, standards and best practices’’ .

The legal practitioner alleged that 400 workers were affected, but the bank confirmed the sack of only 200 in a statement on May 27.

According to Tietie, Diamond Bank goes further to unilaterally deduct supposed? long term loans from the bank accounts of the affected workers against earlier agreed loan tenures.

He said such an action was unbecoming of a Nigerian bank against its staff, which was yet to recover from the trauma and shock of the unexpected termination of their employments. “By that action, they have been further subjected to the punishment of being suddenly thrown into serious financial dire straits. “This is despite the unblemished and meritorious services they had rendered to the bank as committed and dedicated staff for periods ranging from one to 20 years. ’’

He gave the bank 15 working days from the day of receipt of the letter to enter into negotiations with representatives of the affected workers or face legal action.

In a swift reaction, the Head of the bank’s Media Relations Unit, Mr Ikechukwu Omeife, who had earlier reaffirmed the lender’s claim that only 200 workers were affected, explained that the dismissal was part of a rightsizing recently undertaken by the bank to “ optimise cost and enhance value for the shareholders at the end of the business year”.

He said that the affected 200 employees were those whose performance records were lower than the minimum required to drive the bank’s strategic growth plan. Omeife wondered why the lawyer singled out Diamond Bank for attack over an exercise that was a normal practice in the corporate world and which other banks had also undertaken.

However, the photos below just spoke a thousand word:

Follow us on social media:-

News1 day ago

News1 day ago“Only self!sh men are intimidated by women’s success, you should be happy that your woman is successful” – Actress Diva Gold to men

-

Celebrity Gossip & Gist1 day ago

Celebrity Gossip & Gist1 day ago”Competition has started again” – Reactions trail Regina Daniels and co-wife, Laila’s posts about their husband, Ned Nwoko

-

Crime2 hours ago

Crime2 hours agoTwo Anambra revenue collectors set ablaze by irate mob for causing de@th of innocent bystander

-

Celebrity Gossip & Gist1 day ago

Celebrity Gossip & Gist1 day ago“She forms hard to get, but I slept with her the first day I came to her office” – IVD makes bombshell revelation on his relationship with Blessing CEO (Video)